Natural Foods Retail Simulation

Here is a simulation game we recently developed for INFRA (Independent Natural Foods Retail Association) to try to help smaller retailers use business school-like techniques to develop strategies that will help them compete.

Natural Foods Retail Simulation Game

© 2015 by Brickwall Strategy, LLC

THE BEGINNINGS

First Nature Food is an independent chain of five retail stores in Oregon, specializing in natural foods and vitamins.

It was founded in 1987 by Jeanine Robidoux and Clay Kilgore, a pair of college students who had first met during the People’s Park protest in Berkeley, CA in May of 1969. They fell in love, dropped out of school, and went to work at Lemuria, an organic farm near Santa Barbara that was part of a retail/distribution company known as Sunburst. For nearly two years they tended to crops, learned the basics of organic farming, loaded trucks, smoked dope, and sold items at a local farmers market. Sunburst was a little larger and a little more sophisticated than other similar operations, but it was very much a part of the back-to-the-land movement that was happening all over the country in the wake of Silent Spring, the DDT scare, the Summer of Love, the psychedelic movement, and the dawning consciousness of Americans about what was really in their food.

It was founded in 1987 by Jeanine Robidoux and Clay Kilgore, a pair of college students who had first met during the People’s Park protest in Berkeley, CA in May of 1969. They fell in love, dropped out of school, and went to work at Lemuria, an organic farm near Santa Barbara that was part of a retail/distribution company known as Sunburst. For nearly two years they tended to crops, learned the basics of organic farming, loaded trucks, smoked dope, and sold items at a local farmers market. Sunburst was a little larger and a little more sophisticated than other similar operations, but it was very much a part of the back-to-the-land movement that was happening all over the country in the wake of Silent Spring, the DDT scare, the Summer of Love, the psychedelic movement, and the dawning consciousness of Americans about what was really in their food.

In 1972, Robidoux and Kilgore took their new-found skill set with them to Eugene, OR, where they opened up a small bakery called No Wonder – the idea being, they would only sell natural and whole grain foods and would strive to be the very opposite of Wonder Bread. The bakery did OK, and after a few years began to supply local restaurants as well. But it was still a small operation, and Clay had to take a job as a high school English teacher to help make ends meet.

Gradually, the health foods movement turned into the natural foods revolution, and Eugene was a good place to be. Sundance Natural Foods had opened around the same time as No Wonder, and a couple of others followed. It seemed like there might be a good opportunity to expand the bakery into a full-blown grocery store, so in 1987 Janine and Clay took out a small business loan and opened First Nature Nutrition (“Nutrition is more than second nature to us”), a 2,500-square-foot store near the University of Oregon campus that sold things like granola, brown rice, and honey out of bins; some packaged goods from companies like Westbrae, Cascadian Farm, and Arrowhead Mills; organic produce that usually had fruit flies  swarming around it; and a long wall of pill bottles filled with vitamins, herbs, and nutritional supplements. They obtained the lease from an elderly widow, who had operated a yarn store in that location until her health failed – but she hadn’t really kept up with maintenance, so the floorboards creaked, the wiring didn’t support any modern refrigeration units, and it was cold and drafty. Nevertheless, First Nature slowly became a local legend, in large part because of Jeanine’s sugar-free baked goods – multigrain breads, lattice pies, berry turnovers and buckwheat morning muffins – all baked by hand in the old No Wonder store.

swarming around it; and a long wall of pill bottles filled with vitamins, herbs, and nutritional supplements. They obtained the lease from an elderly widow, who had operated a yarn store in that location until her health failed – but she hadn’t really kept up with maintenance, so the floorboards creaked, the wiring didn’t support any modern refrigeration units, and it was cold and drafty. Nevertheless, First Nature slowly became a local legend, in large part because of Jeanine’s sugar-free baked goods – multigrain breads, lattice pies, berry turnovers and buckwheat morning muffins – all baked by hand in the old No Wonder store.

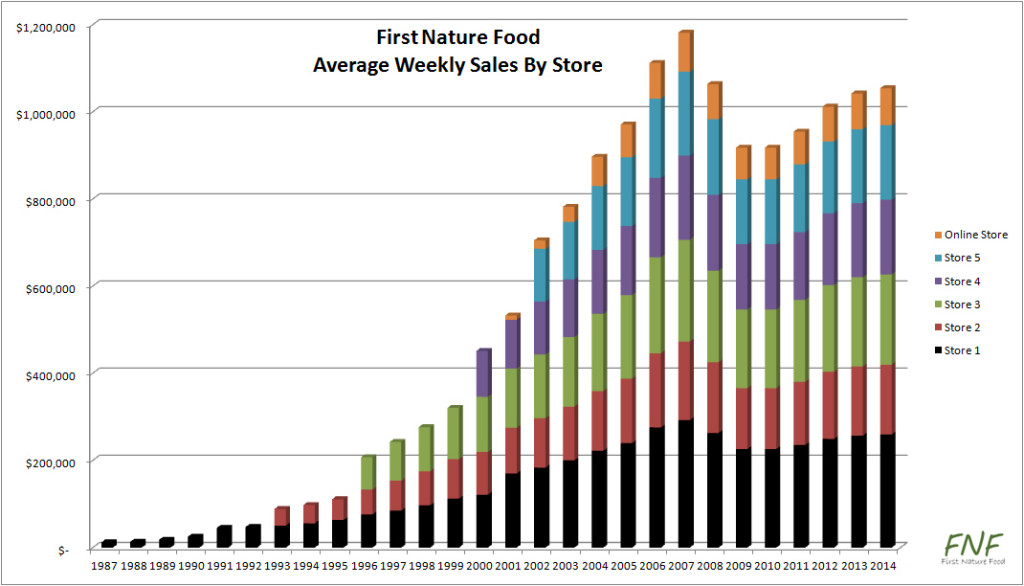

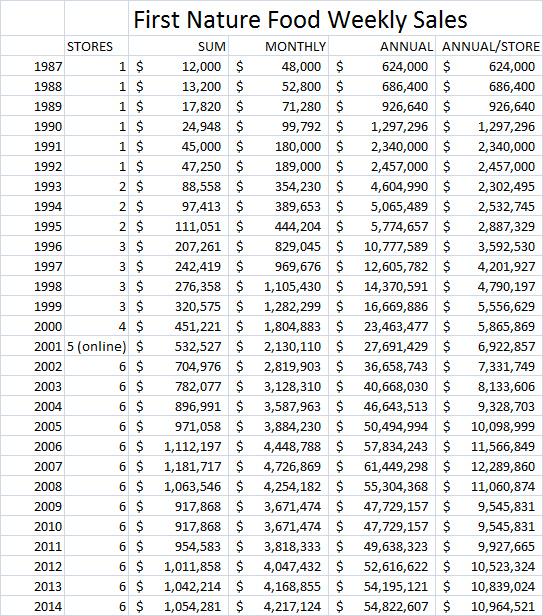

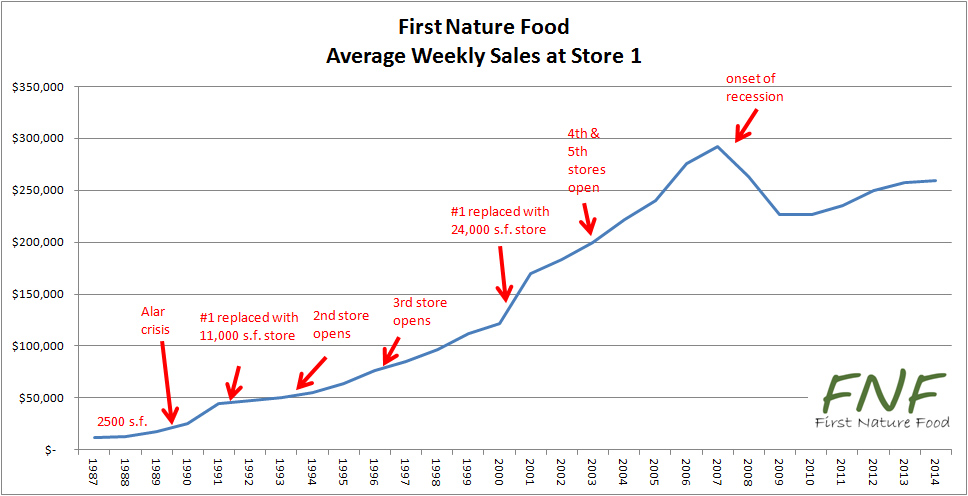

By the end of their first year in business, First Nature was doing about $12,000 in sales each week, and while that wasn’t enough to break even it was close. Jeanine got a loan of $50,000 from her uncle in Chicago (the only family member who hadn’t disowned her when she dropped out of school and started shacking up with Clay), and that kept the business afloat. They turned a small profit in 1988. First Nature’s selection of supplements was one of the largest in Southern Oregon, so they pulled in customers from many miles away; and because of Jeanine and Clay’s connections from their days in Santa Barbara, they were able to bring in many unusual natural and organic products, like creamed papaya fruit bars, Alta Dena yogurt, and Hain nut butters. Most important of all, though, were Jeanine and Clay themselves. They virtually lived in the store, and were renowned for learning their customers’ names, treating them like family, allowing them to buy on credit, offering free delivery in a vintage VW microbus, and even sending birthday gifts to customers. This helped First Nature to stand out from the chain supermarkets like Fred Meyer, the health food stores, and even the local groceries like The Kiva. Their personalities and their amazing level of service became intertwined with the First Nature brand.

EVERYTHING CHANGES

Then in February of 1989, 60 Minutes aired a story about the use of a chemical agent called Daminozide – trade name, Alar. The chemical had been in use for many years on apples and some other crops, but a recent report by the Natural Resources Defense Council had concluded that it was a known carcinogen and would ultimately be responsible for the deaths of thousands of school children, who consumed apple products in high concentrations.

All of a sudden, Jeanine and Clay’s world turned upside-down. Within two days, they started seeing a surge in business. By the weekend, they ran out of organic apples (which were known to be free of Alar) and apple juice, as consumers who had never before set foot in a natural foods store suddenly let fear guide their shopping behavior. First Nature had a record week in early March, and then set another record two weeks later when Newsweek followed up with a story about the “Panic for Organic.” Demand outstripped supply for several months, and this enabled First Nature to raise their prices – which were already fairly robust – and achieve margins of an unheard-of 35%. For the year, business was up more than one-third, to $17,820 a week, or almost a million dollars on an annualized basis.

To capitalize on their good fortune, First Nature moved to an 11,000-square-foot location in Eugene in 1991. And with sales now pushing beyond $45,000 a week, and climbing steadily, First Nature began to think about expansion. They opened a second and much larger store in Eugene in 1993, and rebranded themselves as First Nature Food, since the pills were becoming a smaller portion of the whole mix. This was a big deal for First Nature, and it made the front page of the Eugene Register-Guard.

But all was not as it seemed to be. It was an enormous struggle for Jeanine and Clay to manage the second location. The newer employees didn’t seem as committed to customer service. The No Wonder bakery could no longer keep up with the production schedule, so Jeanine had to outsource the work to a commercial bakery in Portland; and although they were using her original recipes, the taste and quality were not the same. Customers complained that the brand wasn’t what it used to be. Worse, First Nature burned through two store managers in the first six months, so Jeanine had to stand is as store manager at the new location while Clay remained behind to run things at the back office and oversee the store manager at the older store. The two of them hardly ever saw each other. And the stores’ reputation for incredible service also suffered, because, with more than 3,800 customers per week shopping at the two locations, it became impossible to remember their names and to pay attention to the small details.

NEW BLOOD

The following year, 1994, their 7th year in business, they hired a man named Dalton Brackus as President of First Nature. He had worked for PCC, the natural foods coop in Seattle, and had a lot of experience in running multi-unit retail operations. He managed to stabilize things (even though that sometimes meant telling Jeanine and Clay to “stay out of it”), and the company resumed its growth. A third store opened in Bend, OR in 1996, at 18,000 square feet the largest yet. At this point, First Nature was generating $207,000 a week in sales from its three stores, or $3.6 million per year per store. There were now several other health food stores in Eugene and one or two in Bend, but First Nature had emerged as the cream of the crop. Jeanine was just 47 years old, and Clay 46, but the business had gotten big enough and made enough profit that they decided to step out of an active role and join the board. Brackus became the CEO, while Jeanine and Clay’s 23-year-old daughter, Rachel Robidoux-Kilgore, became the #2.

In June of 1997, with the natural foods industry exploding and undergoing waves of investments, mergers, and consolidation, First Nature received a buy-out offer from Safeway, and not one but three unsolicited pitches from private equity firms who wanted to invest upwards of $2 million in the company. Jeanine and Clay were beside themselves with excitement, not just for their own business but for the natural products industry as a whole; but they were also scared, because they remembered all too well what had happened during their first expansion, and felt that by taking on investors they were wading into waters that were too deep. They deflected all of the offers for as long as they could, but by 2000, Dalton Brackus helped persuade them that this might be a once-in-a-lifetime opportunity, and they accepted an offer from RBC Dain Rauscher for a 40% stake in the company, with a “path to control” spelled out through future investments if the company continued to grow and hit certain revenue milestones.

Over the next three years, from 2001 through 2004, First Nature replaced their first store yet again – this go-round, opening a beautiful new 24,000-square-foot facility – renovated the other two stores, launched an 8,000-square-foot bakehouse in Eugene to bring the bakery operations back in-house, and opened two new stores in Salem, OR and Portland, OR. Additionally, Rachel Robidoux-Kilgore’s husband, Jackson McKinney – a dot-com survivor who had worked for both WebVan and Pets.com – launched a First Nature online store, focusing on products for the growing number of people with food allergies. Much to everyone’s delight, the store did exceptionally well, and by 2004 was generating more than $3.5 million a year in sales clear across the country. It was, in fact, because of First Nature’s online store that the investors at RBC Dain Rauscher continued to hold onto their investment.

Overall, there were good years and great years, but sales were always up. By 2007, the five stores were all doing $180,000 a week or more, or $18.3 million a year; and the entire company’s revenues (including online) were better than $61 million. That same year, the company began to contemplate doubling-down on their success by making the jump into another state. A brand new state-of-the-art store was planned for Boise, ID, set to open in late-2008, at the cost of more than $2 million – a huge risk for a company whose net income was about $1.42 million, but also a huge opportunity. Dalton Brackus strongly opposed the move, and as a result was forced out; Rachel Robidoux-Kilgore assumed control over the company at the age of 34, having grown up in the business but also having never known anything other than First Nature. She immediately began work on the Boise store, and started scouting for other locations in Idaho, Washington, and Northern California.

EVERYTHING CHANGES, AGAIN

And then the recession hit, like a ton of bricks. In point of fact, there were a ton of bricks sitting on the construction site in Boise, and all work was immediately halted. For the first time in First Nature’s history, sales began to turn negative: down 10% in 2008, and then down 14% in 2009. Rachel was flummoxed. RBC Dain Rauscher, eight years into their investment and now known as RBC Wealth Management, became uneasy, feeling as if they might have missed their opportunity to cash out. They pressured the rest of the board to demote Rachel, and persuaded Jeanine and Clay, now 59 and 58 respectively and long since out of energy to play an active operational role, to step back in, at least temporarily. This created bitterness and rancor within the family, especially from Rachel’s husband, Jackson, whose online store was still one of the company’s bright spots.

The discord soon radiated out to the board and the stores, and everyone had different ideas about what to do.

- Some members of the board wanted to move ahead with the Boise store, feeling that there was tremendous opportunity and less competition there, not to mention a lot of money already spent; others felt it was better to cut bait.

- The store management team loved Jeanine and Clay, but some of them felt that bringing the founders back in to manage the company meant that things were heading backwards. Others, including some of the buyers and other old timers, felt that the only way to regain the company’s mojo was to return to what had gotten it there in the first place: the core First Nature brand, the strong supplement department, the unique bakery, and the superior customer service that had characterized it in the early days, since none of the competitors could match that (albeit everyone acknowledged it was now harder than ever to find and train and keep good employees).

- Some people at First Nature thought the best way out of the sales slump was to expand the product offerings to include some conventional foods, like Coke and Cheerios, in order to capture more of the “share of pantry” and obviate the need for customers to supplement their First Nature shopping with another trip to Fred Meyer or Safeway; that, after all, was precisely the path that the new hybrid retailer New Seasons was taking up in Portland, to rave reviews. Others said it was finally necessary to acknowledge the effects of the recession, and called for a campaign to lower prices and reduce margins, including the introduction of a First Nature private label line to offer decent products at good prices; First Nature, they said, had earned a reputation for high prices that it needed to shed, because the world had changed and was never going back.

- Still others pushed for a marketing campaign to reintroduce First Nature to the marketplace, reaching out to conventional shoppers as well as core natural foods ones through a broad but sassy advertising campaign, social media, and maybe a sophisticated loyalty card program that could help to identify customers who defected to competitors.

- There was even some talk about closing one or two of the weaker stores, and shifting more of the resources to the still-growing online store.

ENTER, COMPETITION

And then, to make matters worse, just as soon as the recession ended and First Nature’s sales started to slowly recover in 2011 (up 4%), some serious competition entered the market. First, in 2012, Fred Meyer – one of the old school grocery chains – opened a natural foods spinoff store in Eugene, called Better Off Fred. It looked a little like a half-size Fred Meyer store, but it sold all-natural and organic food at significantly lower prices than First Nature, and also included a scratch bakery that made some things that looked suspiciously like the best-selling recipes of Jeanine Robidoux; clearly, they had done their homework. Then in 2013, Zupan’s Markets, an upscale family-run gourmet store that had been around Portland for more than 40 years, opened in Bend, and at least temporarily stole 15% of First Nature’s business.

And of course, looming in the background was Whole Foods Market, the biggest and best natural foods chain in the country, with over $10 billion in sales. They had never had a big presence in Oregon, but in 2007 had purchased Wild Oats, which itself had purchased Nature’s Fresh Northwest – Oregon’s original natural foods chain – in 1999. This suddenly opened up talk about an expansion, and it was widely rumored that Whole Foods would begin opening smaller format stores throughout the state (although, at 35,000-to-50,000 square feet, still considerably larger than even the largest First Nature store). Social media were all abuzz about the possibility of these Whole Foods stores, but so far the company had yet to take any action.

WHAT TO DO NEXT?

Sales at First Nature had recovered from the recession, but only a little: up 4% in 2011, 6% in 2012, 3% in 2013 and 1% in 2014. With five stores ranging in age from 12 to 21 years, averaging $194,000 in sales a week ($11 million a year), a sixth store planned but never built, an online store, total sales of just over $54 million and profits of $1.33 million, First Nature still looked like a success story. And it was. But the momentum had clearly shifted, the wolves were at their doorstep, and as they entered 2015, Jeanine and Clay had some big decisions to make:

- Should they proceed with the long-delayed Boise store, seeking greener and less competitive pastures? Or would that be that throwing good money after bad?

- Instead, should they go the other route, closing the weaker stores and perhaps directing more resources online?

- Should they sell their own stake in the company, giving RBC Wealth Management control, knowing full well that the investment banking firm would almost certainly turn right around and sell it to someone else, ending First Nature’s long run? Or should they hang on, or maybe even try to buy back RBC’s stake?

- Should they bring in a new CEO, further imperiling their daughter’s career, perhaps losing her husband Jackson’s support (and his contributions in running the online store), and introducing more uncertainty into the corporate culture? Or should they fight with RBC to bring her back?

- How should they deal with the competitive incursions of the discounter Better Off Fred and the upscale Zupan’s Markets?

- Is there anything they can do to dissuade Whole Foods from moving ahead with its expansion plans?

- Which, if any, of the suggested fixes would work best: lower prices and a private label program, more marketing and a loyalty program, a return to the emphasis on customer service, or an expansion of the product set into a more hybrid arrangement?

- How valuable is the First Nature Food brand in the changed economic and competitive environment? Should they invest the time, money, and effort into revitalizing it – and if so, how? Or is the name of the game now all about real estate, product selection, and price?

THE SITUATION

The First Nature board consists of seven people: Jeanine Robidoux and Clay Kilgore; Barton Stevens and Elizabeth Rausch of RBC Wealth Management; Professor Mark Rosen of the University of Oregon, an old friend and teaching colleague of Clay and an original investor in First Nature; Bob Perkins, the CEO of Game On, a chain of sporting goods stores that used to be part of the RBC Wealth Management portfolio; and one seat held by your firm, the independent strategy consulting firm of Grubb & Dobrow.

A board meeting is slated for next week. Each board member is expected to make a 10-to-15 minute presentation analyzing the current situation, the universe of solutions (both those in play and any others they can think of), and presenting its strongest recommendations.

You can more or less anticipate how the camps will split, so the likelihood is that your presentation and vote will decide the next move.

Ready? Go.